Our Hsmb Advisory Llc Statements

Our Hsmb Advisory Llc Statements

Blog Article

6 Easy Facts About Hsmb Advisory Llc Shown

Table of ContentsMore About Hsmb Advisory LlcHsmb Advisory Llc for DummiesThe Buzz on Hsmb Advisory LlcHsmb Advisory Llc for DummiesExcitement About Hsmb Advisory LlcNot known Details About Hsmb Advisory Llc

Ford claims to stay away from "money value or long-term" life insurance policy, which is even more of a financial investment than an insurance coverage. "Those are really complicated, included high payments, and 9 out of 10 people do not require them. They're oversold due to the fact that insurance representatives make the largest commissions on these," he claims.

Special needs insurance coverage can be expensive, however. And for those that choose long-term treatment insurance, this plan might make special needs insurance unneeded. Read extra concerning lasting treatment insurance and whether it's ideal for you in the following section. Long-term treatment insurance can help spend for expenditures connected with long-lasting care as we age.

Hsmb Advisory Llc Fundamentals Explained

If you have a persistent wellness issue, this sort of insurance can wind up being vital (Health Insurance St Petersburg, FL). Do not let it stress you or your financial institution account early in lifeit's normally best to take out a policy in your 50s or 60s with the expectancy that you will not be utilizing it until your 70s or later.

If you're a small-business proprietor, consider protecting your resources by acquiring company insurance. In the event of a disaster-related closure or period of restoring, business insurance coverage can cover your earnings loss. Consider if a significant climate occasion impacted your store or production facilityhow would certainly that affect your income?

Plus, making use of insurance policy can sometimes set you back more than it saves in the long run. If you obtain a chip in your windshield, you might consider covering the repair work cost with your emergency situation financial savings rather of your auto insurance coverage. Life Insurance.

The Of Hsmb Advisory Llc

Share these pointers to safeguard liked ones from being both underinsured and overinsuredand talk to a relied on expert when required. (https://www.evernote.com/shard/s437/sh/40a76dc3-38e0-0732-8348-3cc8a3f5b803/WglbUY955HF0iHFC-xF_ihR4Wr_rkfwcJXv2YfnxMONyJH8_c_KYgTgg9A)

Insurance coverage that is bought by a private for single-person protection or insurance coverage of a family. The private pays the premium, as opposed to employer-based health insurance where the employer typically pays a share of the premium. People might buy and purchase insurance coverage from any type of strategies available in the person's geographic region.

People and family members might qualify for financial aid to reduce the expense of insurance coverage premiums and out-of-pocket costs, however just when registering via Attach for Wellness Colorado. If you experience particular changes in your life,, you are qualified for a 60-day duration of time where you can enroll in a specific strategy, also if it is outside of the yearly open enrollment duration of Nov.

15.

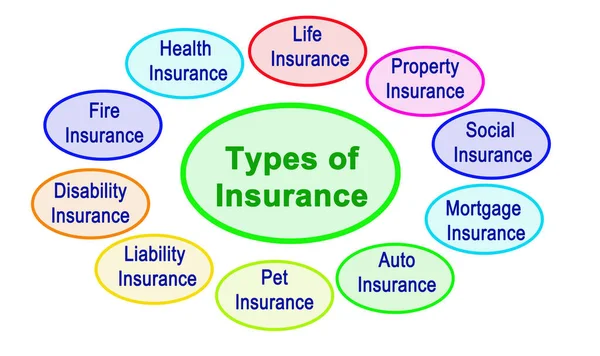

It might appear straightforward however comprehending insurance coverage kinds can likewise be puzzling. Much of this confusion comes from the insurance industry's ongoing goal to develop personalized coverage for insurance holders. In making flexible plans, there are a range to choose fromand every one of those insurance policy kinds can make it tough to comprehend what a specific plan is and does.

Rumored Buzz on Hsmb Advisory Llc

The very best place to begin is to speak about the difference in between the two sorts of basic life insurance policy: term life insurance coverage and long-term life insurance policy. Term life insurance policy is life insurance policy that is just active for a while duration. If you die throughout this duration, the person or individuals you've named as beneficiaries might obtain the cash payment of the plan.

Lots of term life insurance plans allow you convert them to a whole life insurance home coverage plan, so you don't lose insurance coverage. Generally, term life insurance policy policy premium settlements (what you pay monthly or year into your policy) are not locked in at the time of purchase, so every five or 10 years you have the policy, your premiums could climb.

They additionally tend to be more affordable overall than whole life, unless you purchase a whole life insurance coverage policy when you're young. There are also a few variations on term life insurance policy. One, called team term life insurance policy, is typical amongst insurance choices you could have access to via your employer.

Some Known Incorrect Statements About Hsmb Advisory Llc

One more variation that you might have access to via your employer is extra life insurance., or interment insuranceadditional coverage that can aid your family members in instance something unanticipated takes place to you.

Permanent life insurance policy simply describes any life insurance coverage policy that does not end. There are a number of kinds of long-term life insurancethe most usual types being entire life insurance policy and universal life insurance policy. Entire life insurance is precisely what it seems like: life insurance policy for your entire life that pays to your beneficiaries when you die.

Report this page